As physicians and patients continue to turn towards virtual visits during the COVID-19 pandemic, both the Centers for Medicare and Medicaid Services (CMS) and commercial payers continue to tweak their telehealth regulations and policies to support this transition.

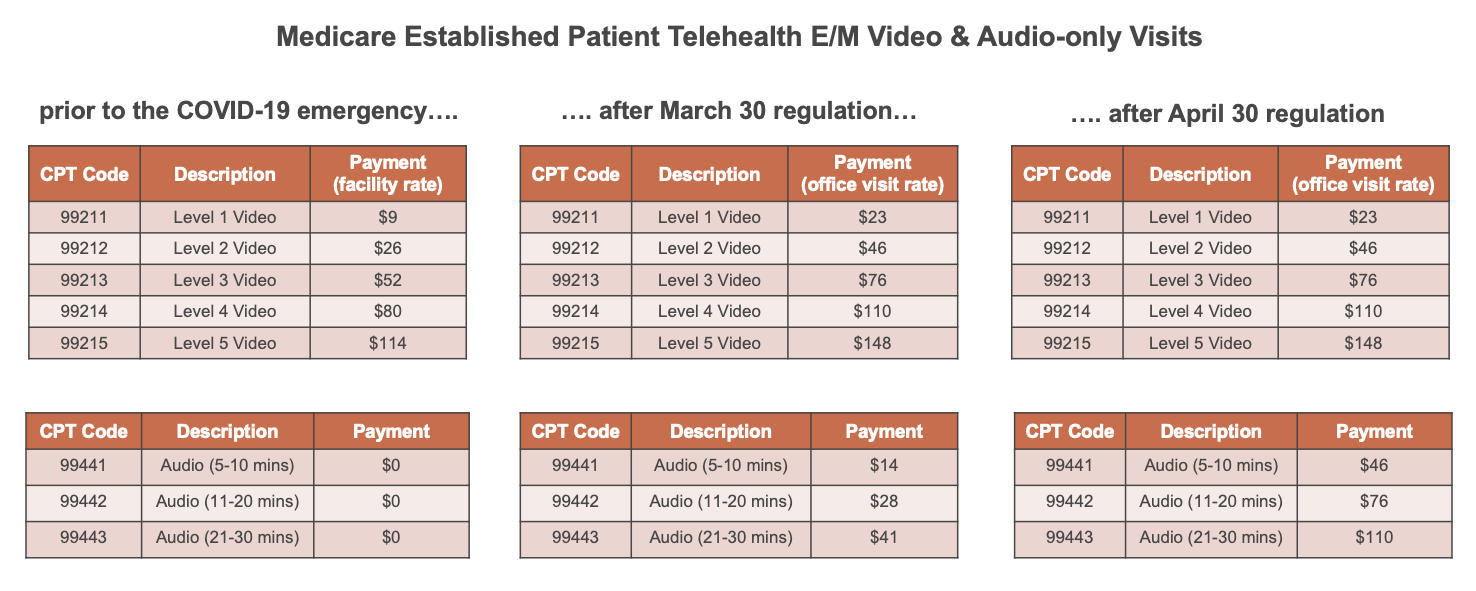

Prior to the pandemic, Medicare only paid for telehealth services on a very limited basis: when the patient receiving the service was in a rural geographic area and when they left their home to go to a medical facility (i.e. hospital or physician’s office) to receive an approved service from an approved provider in a different location via real-time audio and video technology. Telehealth services were also paid at CMS’s facility rate, which for a common Evaluation and Management (E/M) visit, is approximately $20 lower than the non-facility rate paid for delivering a service in-person in the office.

Following the President’s national emergency declaration, on March 17 CMS announced it was expanding Medicare telehealth benefits for the duration of the emergency by waiving the rural area and facility requirements, enabling the delivery of telehealth services in all areas of the country to patients who can remain in their homes. As a result, the number of Medicare beneficiaries receiving telehealth visits increased from 10,000 per week in early March to 300,000 per week by the end of March (according to CMS).

Then, on March 30 CMS issued a regulation further expanding telehealth benefits and increasing telehealth payment rates during the emergency. The regulation added more than 80 additional services to the list of covered telehealth services and changed billing rules to allow providers to bill for telehealth visits at the same rate as in-person visits (the non-facility rate). The regulation also authorized payment for certain audio-only telephone visits; however, at a lower payment rate than video visits.

A month later, on April 30, CMS made another round of regulatory changes through a 279-page regulation. Most importantly for telehealth, this regulation increased payment for telephone visits to match the rates paid for similar outpatient office and telehealth video visits. Retroactive to March 1, this change increased payment for the audio-only visit codes (99441,99442, 99443) from a range of $14-$41 to $46-$110.

As a result, Medicare is now paying the same rate for level 2-4 E/M services whether delivered in-person, via video, or via phone. However, because that payment parity and the temporary lifting of geographic and physical location restrictions is only effective for the duration of the national emergency, many industry stakeholders are already wondering what will happen after the emergency.

Although Congress is ultimately responsible for determining the relative payment rates for telehealth services, the current CMS Administrator, Seema Verma, has indicated CMS’s support for making some its emergency policies permanent. Verma said recently, “I think it’s fair to say that the advent of telehealth has been just completely accelerated, that it’s taken this crisis to push us to a new frontier, but there’s absolutely no going back.”

Meanwhile, some commercial payers are already setting their telehealth policies for the post-emergency world. Last week, BlueCross BlueShield (BCBS) of Tennessee, the state’s largest insurer, announced it was making its COVID-19 expansion of telehealth coverage permanent. The insurer’s policy – which covers telephone and video visits with in-network providers– drove an 18x increase in telehealth claims during its first month (March 16-April 14) compared to the same period last year.

Whether or not other commercial insurers, states, or the federal government follow Tennessee BCBS’s lead in making temporary pandemic policies permanent remains to be seen, but some level of change is certain.

Meet NextGen Ambient Assist, your new AI ally that generates a structured SOAP note in seconds from listening to the natural patient/provider conversation.

Read NowCategories

- Analytics and Reporting

- Regulatory Updates

- Artificial Intelligence (AI)

- Community Health

- COVID-19

- Dental

- Documentation

- Electronic Health Records

- Financial Management

- Health IT 101

- Industry news

- Integrated Care

- Interoperability

- Mobile EHR

- NextGen Advisors

- Patient Experience

- Practice Management

- Provider Experience

- Patient Engagement

- Population Health

- Revenue Cycle Management

- Small Practice

- Telehealth

- Value-based Care